Read this guide to learn more about the 529 college savings plan and how it may be able to facilitate payment of your children’s higher education expenses. Understand what it is and how the plans work to help you better develop a strategy on how to pay for an advanced degree.

Read this guide to learn more about the 529 college savings plan and how it may be able to facilitate payment of your children’s higher education expenses. Understand what it is and how the plans work to help you better develop a strategy on how to pay for an advanced degree.

What is a 529 Plan?

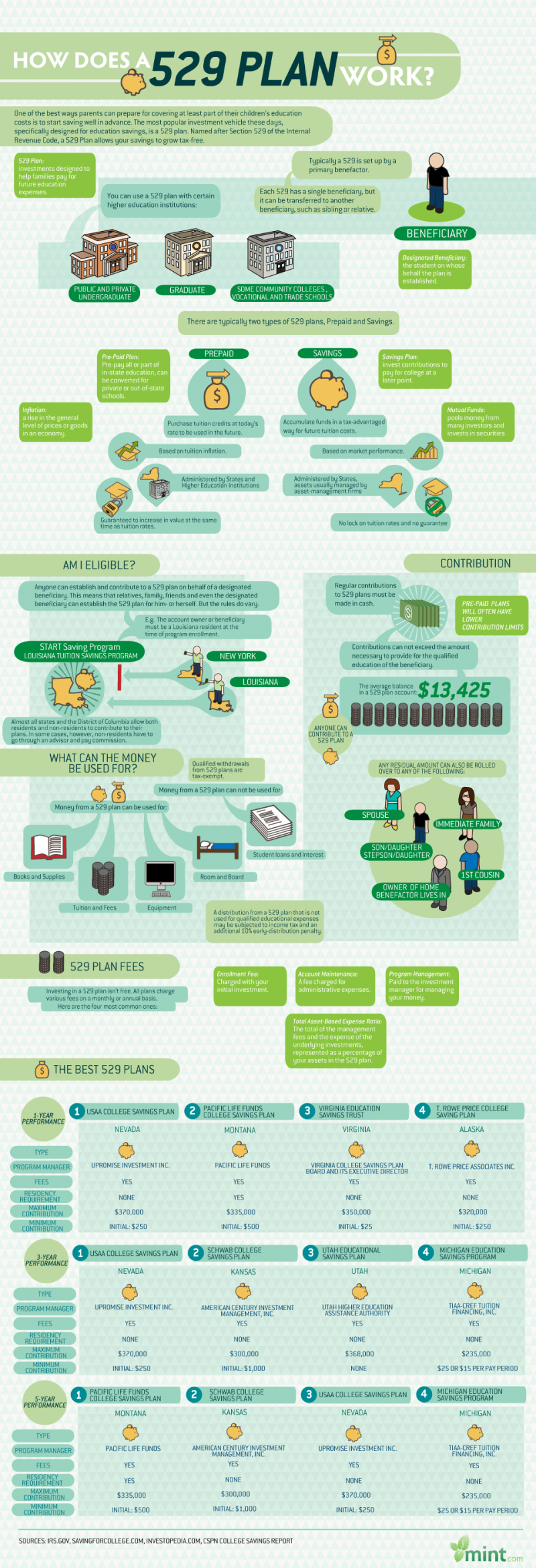

It is an investment program that comes with tax-advantages so long as the monies from the fund are used for qualified expenses on higher education, for the designated beneficiary of the investment account. In essence, it is a qualified tuition program designed to help pay for, and encourage more people to seek college, university and advanced degrees. The various plans are authorized by Section 529 of the Internal Revenue Code and are sponsored by state agencies and educational institutions.

Qualified Tuition Program:

For an investment fund to qualify for the distinction of a tax advantage program, it must meet specific requirements, which may also vary by state. It is important to understand the requirements and qualifications before venturing into a long-term investing situation, since it is critical that the monies from any 529 college savings plan, be suitable for the educational goals of the designated plan beneficiary.

A simplified overview of some of the 529 plan requirements are as follows:

- Investment program should have received a ruling that it meets all requirements

- Monies to be held in a qualified trust

- Contributions can only be made in cash

- Must provide for separate accounting of each named beneficiary

- A named beneficiary can not direct any investment of the fund or program

- Investment interest can not serve as security for any type of loan or debt

- Contributions can not exceed the program parameters

The definition of ‘qualified higher education expenses‘ can be confusing for some people since it is often a moving target. However, in general these expense items may include class tuition fees, other school fees, necessary equipment, school supplies, books, technology and other items that may be required in order to complete the required classes and coursework at an eligible college, university or other educational institution. In the case of named beneficiaries that require special needs, additional expenses may also qualify. Also, if the designated beneficiary attends classes and are considered at least half-time students, then costs directly related to room and board may also qualify as allowed expenses under a 529 plan. Depending upon the state you are in, then these definitions and requirements may be subject to change. Before investing in any savings program make sure to understand the current regulations as it relates to the eligible educational institution you, or the beneficiary, wish to attend.

Also keep in mind that there may be fees and other expenses required to setup and maintain a 529 plan, so be sure to understand what these cost are and how they may lower or reduce your investment returns.

Disclaimer: Nothing within this post should be considered financial advice. It is important that you consult with your CPA or other financial professional to ensure that you setup an appropriate program that meets your educational goals.

• GradSave.com 529 college savings plan review

Resources:

Related posts:

- Gradsave.com for 529 College Savings Plan Review

- What is Personal Finance?

- Prescription Savings Card

- Walgreens Prescription Savings Club

- Printable Coupons for Real Savings